Fixed Indexed Annuity Review

The purpose of this website is education. Everyone's situation is unique and will vary based upon many factors which include, but are not limited to, their income, net worth, financial goals, risk tolerance, debt, expenses and age. Any income guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company. The information posted on this website is general information only. This is not intended to be used as your sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of your unique situation.

Discover potential benefits of potential growth, income and legacy planning for part of your portfolio for retirement planning in Omaha Nebraska and Lincoln Nebraska and Council Bluffs, Millard, LaVista, Bellevue, Papillion, Nebraska, Iowa. Fixed indexed annuity information, fixed annuities, annuity rates, annuities for retirement income. Certified Financial Fiduciary®

Investment advisory services offered through the Impact Partnership Wealth, LLC ("IPW"), a Securities and Exchange Commission Registered Investment Advisor firm. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

Investing involves risk. There is always the potential of losing money when you invest in securities. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets.

Past performance may not be indicative of future results. IPW, its affiliates, and its investment adviser representatives do not provide legal, tax, or accounting advice. You should consult your legal and/or tax professionals before making any financial decisions.

Please be advised that you may conduct securities transactions only by speaking directly with your Investment Advisor Representative either by phone or in person.

No information or material presented on this website is intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. IPW offers a broad range of investment advisory (including financial planning) and other services. Additional information is available in our Client Relationship Summary which can also be accessed here on this website, https://impactpartnershipwealth.com/docs/Impact-Form-CRS.pdf.

Insurance and annuities offered through Michael Riedmiller, NE Insurance License #17294119.

Please be advised that the securities advice offered, securities transactions conducted and assets under management services rendered by Impact Partnership Wealth, LLC are not:

Are Not FDIC Insured

Are Not Bank Guaranteed

May Lose Value

Are Not Deposits

Are Not Insured by Any Federal Government Agency

Are Not a Condition to Any Banking Service or Activity

Privacy Notice:- https://impactpartnershipwealth.com/docs/IPW-Privacy-Policy.pdf

Michael Riedmiller wrote articles for Forbes Brand Voice from 2018 – 2019. This was a paid program. Opinions expressed are subject to change without notice and not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decisions.

The Road To Success book, Amazon 2016 best-seller list. Performance 360 book, Amazon 2018 best-seller list. National Academy of Best-Selling Authors (NABSA) is a membership organization owned by Dicks + Nanton Celebrity Branding Agency. Qualifying criteria for membership includes an application process and proof of appearance on one Best-Seller category on Barnes&Noble.com or Amazon.com. NABSA membership requirements include the payment of annual dues. NABSA logos and/or trademarks are property of their respective owners and no endorsement of Mike Riedmiller or Riedmiller Wealth Management is stated or implied. The Quilly Award and attendance of the ThoughtLeader Summit and Golden Gala awards are additional options within NABSA membership. Requirements for receiving a Quilly Award and attending the ThoughtLeader Summit and Golden Gala awards include the payment of additional dues. For the detailed requirements of NABSA, please visit: http://www.bestsellersacademy.org/about-the-national-academy-of-best-selling-authors/

Ethics.net is owned by the National Ethics Association (NEA). NEA is a membership organization. Qualifying criteria for membership includes passing a background check. NEA membership requirements include the payment of annual dues, compliance with ethical standards, and passing yearly background checks. The NEA and Ethics.net logo and/or trademarks are property of their respective owners and no endorsement of Mike Riedmiller or Riedmiller Wealth Management is stated or implied. For the detailed requirements of NEA and Ethics.net, please visit: https://www.ethics.net/terms-and-conditions

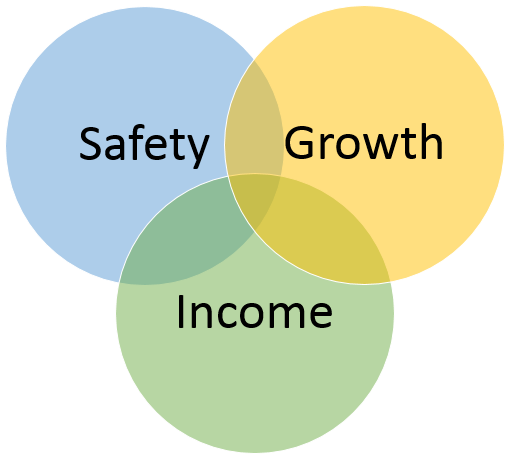

Fixed Indexed Annuity Potential Benefits*

Your account value can potentially increase when the market index is up

Your account will not decrease when the market is down

Option for lifetime income if you choose

Tax deferred potential growth

* When structured correctly with the proper fixed indexed annuity. Any income guarantees

are contingent on the financial strength and claims-paying ability of the issuing insurance company.

Additional Resources

Mike Riedmiller, CFF is a CERTIFIED FINANCIAL FIDUCIARY® and the President of Riedmiller Wealth Management, an independent financial firm that is free from the product-focused, sales-driven environment that can be prevalent at other financial institutions.

Mike focuses on retirement planning and wealth management. He believes it is more important than ever for people to be educated about money and their financial options.

Mike Riedmiller is passionate about building long-term relationships with his clients to help them potentially achieve their important life goals and financial objectives. The cornerstone of this strategy is a foundation of education and real world application of knowledge and experience. He strives to create value within these relationships by carefully listening to clients and understanding what is important to them.

Mike Riedmiller has attended different financial industry training and educational events about finance and retirement planning.

Mike's Family

Mike and his wife, Carisa, have been married since 1995 and live in Nebraska. They have three children, and enjoy spending time with family and friends, biking, hiking, reading and meeting new people. They have traveled throughout the United States and to other countries in order to have new experiences and lifetime memories with their family.

Mike Riedmiller worked with other professionals and entrepreneurs along with Best-Selling Author® Jack Canfield, originator of the Chicken Soup for the Soul® series of books, to co-author the book "The Road to Success".

"The Road to Success" achieved Best-Seller status reaching as high as #3 in the “Direct Marketing” Amazon category as well placing #17 on “Sales and Selling,” #48 in “Entrepreneurship,” #58 in “Marketing,” and #83 in “Marketing and Sales” in 2016. Mike Riedmiller contributed a chapter called “At War For Your Money - Do Not Get Caught in the Crossfire”.

About This Amazon Best-Selling Book

To take a road trip to success, we will need a destination as well as a GPS. Success is described here as the achievement of a goal. The goals we adopt may be the result of experience, vision or desire. They crystallize our desire to get to a better place.

Having picked a goal for success? How do you get there? What drives you on? Some more popular goals include amassing wealth, gaining recognition and a desire to improve the lifestyle of others. It is also interesting to note that both philosophers as well as successful travelers on this road to success tell us that the journey is the real prize, not merely arriving at the destination.

Amazon Best-Selling Book

About Mike Riedmiller

CERTIFIED FINANCIAL FIDUCIARY®

View more on social media: